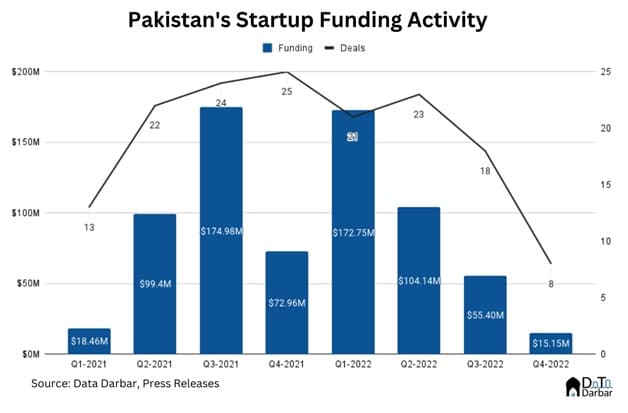

Investment in Pakistan’s tech ecosystem continued its downward trend in Q4-2022, declining to just $15.15 million, according to data released by Data Darbar. This is the worst quarter for startup funding since Q1-2020 when investment stood at $5.025 million.

The investment in Q4-2022 plunged by 79.24 percent compared to the investment of $72.96 million in Q4-2021 on a year-on-year (YoY) basis. The quarter-on-quarter (QoQ) decline was also above 70 percent, coming in at 72.65 percent compared to the investment of $55.40 million in Q3-2022.

The deal count also fell to 8 in Q4-2022, the first time since Q2-2020 that the number of deals was in single digits (7). The deal count was down 68 percent on a YoY basis compared to 25 deals in Q4-2021. The decline in deal count on a QoQ basis came in at 55.57 percent compared to 18 deals in the previous quarter.

Total investment

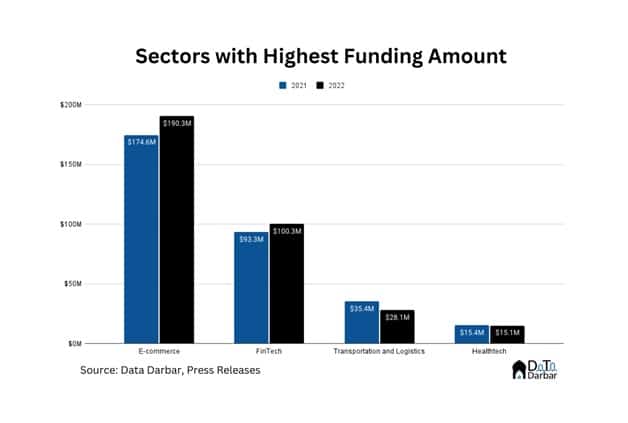

Total investment in startups fell to $347.44 million in 2022, down 5 percent from $365.8 million in 2021. The deal count also declined to 70 during 2022, compared to 84 in 2021.

The sector-wise breakdown shows that e-commerce led in funding value with $190.27 million raised across 16 deals in 2022. The amount was higher than the $174.6 million raised in 2021. Fintech topped the number of deals, raising $100.3 million across 19 deals. The transportation and logistics sector raised $28.1 million while healthtech raised $15.1 million.

The stage-wise breakdown shows that Series A recorded the highest funding of $133.5 million, seed followed at $83.35 million and Series B funding stood at $80 million in 2022.

The data further shows that female founded startups raised $4.35 million across 5 deals and female co-founded startups bagged $21.55 million across seven deals in 2022.