Pakistan has one of the lowest financial inclusion ratios in the world, with only 21.3 percent of the population having access to banking services, within which only 14.3 percent make digital payments, according to research by the World Bank in 2017. This indicates the low priority given to the digital payment ecosystem either due to the traditional banking mindset such as the use of paper for checks and money orders or due to other structural problems.

The use of digital payments and online shopping increased abruptly during the prevailing condition of the pandemic. However, businessmen, traders, and freelancers are still facing digital payment services issues as PayPal – a worldwide banking channel offering online transactions – has declined to initiate its services in Pakistan.

PayPal is an American company and is internationally the largest third-party services provider of monetary transactions with high-tech accounts security and a top-notch financial management system that operates in about 200 markets and has 277 million registered accounts. It also allows its customers to send, receive, and hold funds in 25 currencies.

The Pakistani freelancing community comprises around 200,000 freelancers and over 7,000 registered small and medium enterprises (SMEs) that are majorly in need of PayPal services to be able to do business with international companies without the hassle of currency transfer.

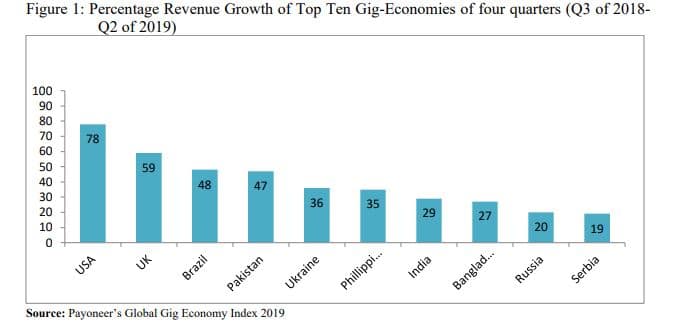

Pakistan has been ranked as the fourth fastest-growing freelance market with a 47 percent revenue growth in freelance (Payoneer, 2019) and is outperforming regional countries like India and Bangladesh, and Russia.

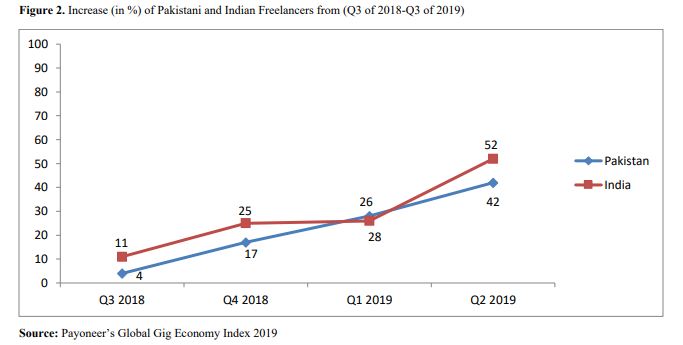

Pakistani freelancers increased by 38 percent, which is slightly less than India (41 percent) from the third quarter (Q3) of 2018 up to the second quarter (Q2) of 2019.

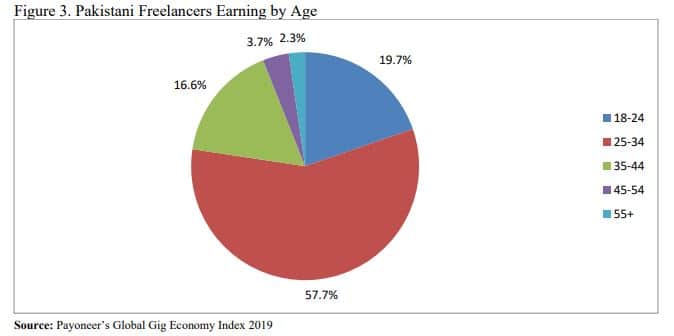

In Pakistan’s case, this increase in the number of freelancers is fueled by a very young population of 77.3 percent under the age of 35 (Figure 3).

It has become possible because of technically oriented training supported by practical-indicating young people who are increasingly participating in economic activities.

Payoneer’s Head of Pakistani Business Development, Mohsin Muzaffer, stated that “4G coverage across Pakistan has given freelancers unprecedented access to international jobs”.

If 4G coverage contributes to increasing the number of freelancers, freelance earnings, and international jobs, the provision of digital payment services like PayPal will be helpful in receiving those earnings from international jobs in an easy and secure way.

Although the major contributors are young Pakistani freelancers who fuel the gig economy, why are they unable to do business more smoothly in the fourth-largest freelancing country? Why is a major international payment gateway such as PayPal not operating in Pakistan? Why are freelancers deprived of a secure and trusted payment system? Why is PayPal operating in underdeveloped countries like Nigeria, Kenya, Somalia, Angola, Burundi, Chad, and Comoros but not in Pakistan?

Delegations from the government of Pakistan met with PayPal’s authorities in recent years to discuss these issues but it refuses to initiate its services in Pakistan.

Senator Mian Mohammad Ateeq Shaikh remarked in a meeting of the Senate Standing Committee on IT that “PayPal is afraid to come to Pakistan unless there are laws to protect the company’s interests”.

There are also some more serious concerns behind PayPal’s refusal to operate in Pakistan that are preventing the growth and effectiveness of its digital payments ecosystem. Firstly, major international payment gateways such as PayPal, Google Pay, and Stripe have zero tolerance for money laundering which is highly prevalent in Pakistan due to various loopholes. Pakistan is still on the Financial Action Task Force’s (FATF) grey list and is being monitored for its widespread money laundering.

Secondly, credit cards have been the driver of the digital payment ecosystem and PayPal looks into Point of Sale (POS) and credit cards penetration, which is not healthy in Pakistan.

Thirdly, any international company that is willing to work in Pakistan has to pay a $2 million license fee, which is a massive amount for companies like PayPal that earns two to three percent per transaction, according to the State Bank of Pakistan (SBP).

Fourthly, just after PayPal introduced its services in India and Bangladesh, it faced strict restrictions regarding the holding of any amount in a PayPal account due to the State’s Bank’s regulations. This fear led PayPal and similar companies to hesitate to come to South Asia and especially Pakistan.

As an alternative to PayPal, freelancers in Pakistan go through a lengthy and insecure process to make online international transactions. They begin by opening up bank accounts in the United States to get verified PayPal accounts in Pakistan. Then, they link their PayPal accounts to other third-party service providers of monetary transactions such as Payoneer and Xoom to make transactions in Pakistan. These alternatives are not as efficient, trustworthy, and feasible as PayPal is. Payoneer Prepaid MasterCard holders recently lost access to their accounts as the issuer of cards — a German firm called ‘Wire Card AG’ faced a scandal.

Pakistan’s government, the Ministry of Information Technology and Telecommunication, and the SBP must make policies to launch programs to develop and promote a culture of freelancing by providing digital payment solutions so that the digital payment ecosystem flourishes in Pakistan. For instance, India launched programs like Startup India, Skill India, and Digital India to foster local businesses. These programs facilitated a 52 percent increase in the number of Indian freelancers as compared to a 42 percent increase in Pakistani freelancers since Q3 of 2018 to Q3 of 2019 (Figure 2).

Government must essentially eliminate money laundering, minimize the overregulation of the banking system, control cybercrime, and update the financial industry from legacy systems to open Application Programming Interface (API) platforms to make the integration of different providers easier.

Under the ongoing COVID-19 situation and devastating economic crises, it is a high time the incumbent government started taking the right steps by providing more favorable conditions to boost e-commerce and a digital payment ecosystem to facilitate Pakistani freelancers and traders in metropolises like Karachi, Faisalabad, and Gujranwala to join them.

About the Author

This article has been written by Safyan Shams who is pursuing a Master of Philosophy degree in Public Policy at the Pakistan Institute of Development Economics Islamabad. He is doing research work on Behavioral Public Policy in the context of COVID-19 in Pakistan.