In a recent analysis, ProPakistani revealed how Pakistan can make billions of rupees in taxes per year by simply taxing cryptocurrencies in Pakistan.

For a cash-strapped country like Pakistan, this alone should be reason enough to start the process of regulating the booming crypto market. However, in reality, there are even more benefits to regulating cryptocurrencies in Pakistan.

To get an understanding of where Pakistani public’s interest in the crypto market, take a look at how Pakistanis are faring in cryptocurrencies and the impact that it has had on the country so far.

The Numbers

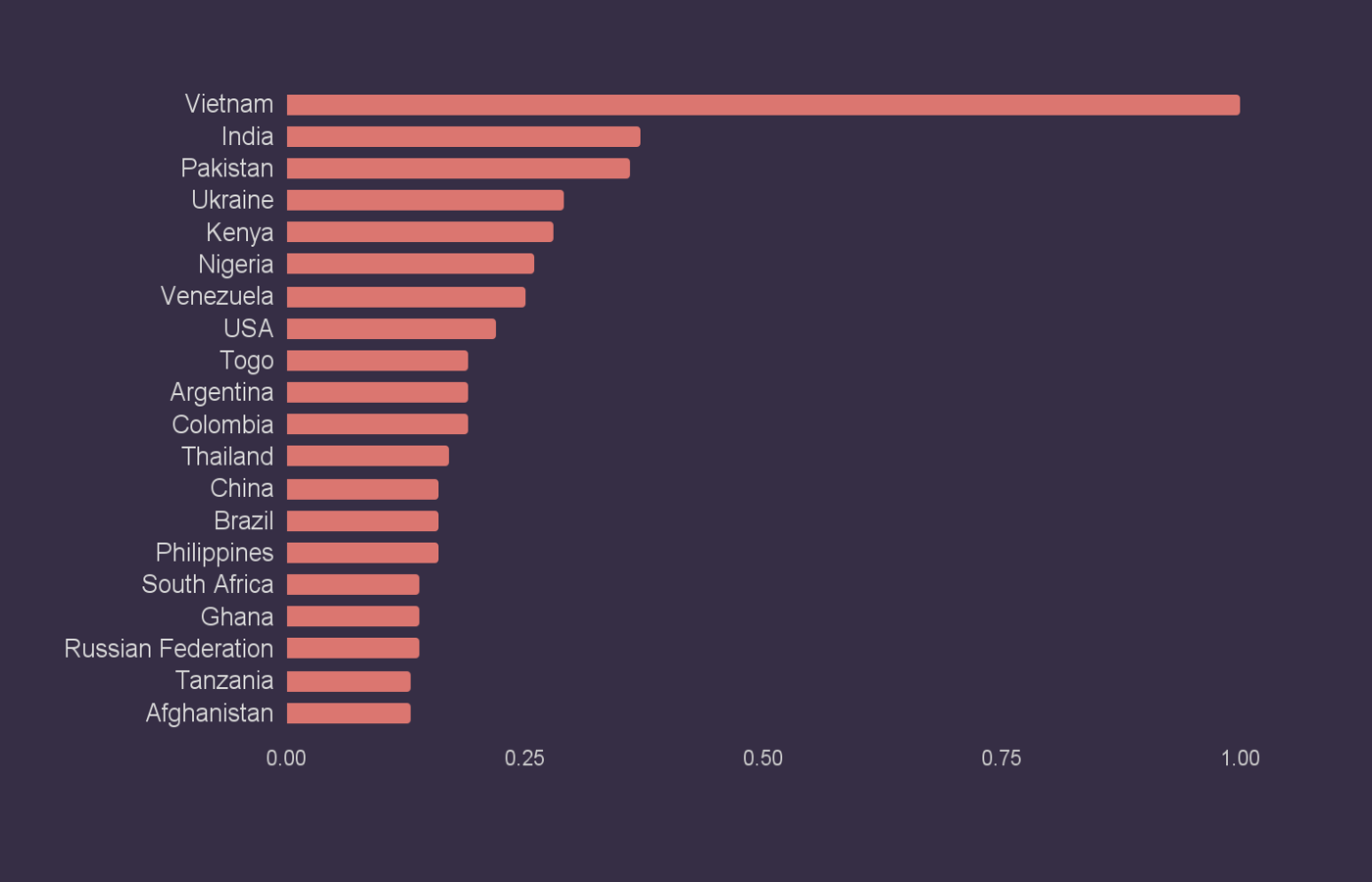

According to Chainalysis — a research firm specializing in analyzing crypto-assets, Pakistan currently ranks third in the Central and Southern Asia region in crypto adoption. In fact, Pakistan is neck to neck with India in terms of cryptocurrency adoption and may soon surpass the massive Indian market, if provided a legal cover like our Indian neighbors.

Pakistan Ranks Third in Crypto Adoption in Central and Southern Asia region

In case you are wondering how Chainalysis ranks various markets, they look at the following three parameters:

- On-chain value received, weighted by purchasing power parity per Capita.

- P2P trade volume, weighted by purchasing power parity per capita and the number of internet users.

- Retail value (from transfers < $10K), weighted by purchasing power parity per capita.

Pakistan ranks 8th in terms of P2P trading volume globally (out of 154 countries)

P2P trade, if you aren’t familiar, is the crypto trading done between individuals on various exchanges, such as Binance. In P2P trading, the seller sends a crypto coin to a buyer, against a local currency that they exchange via bank accounts or in cash.

P2P data is usually public and can be tracked by third parties.

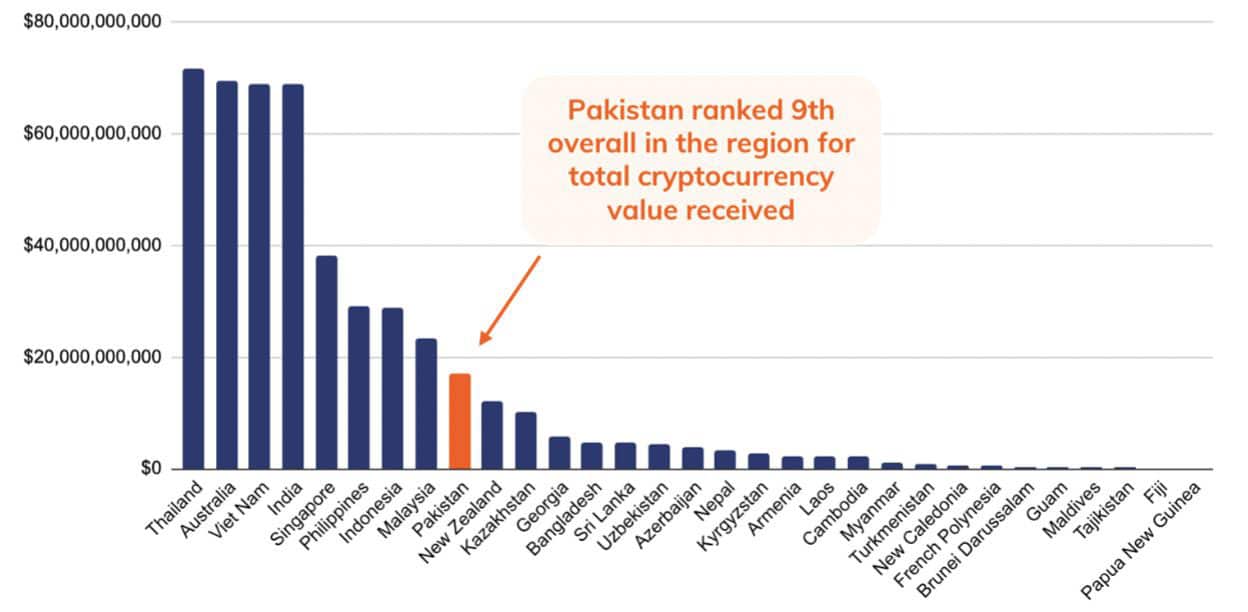

Pakistan received $18.6 billion in estimated value between July 20 and June 21

At Least 1 to 2 Million Pakistanis Trade Crypto Currencies

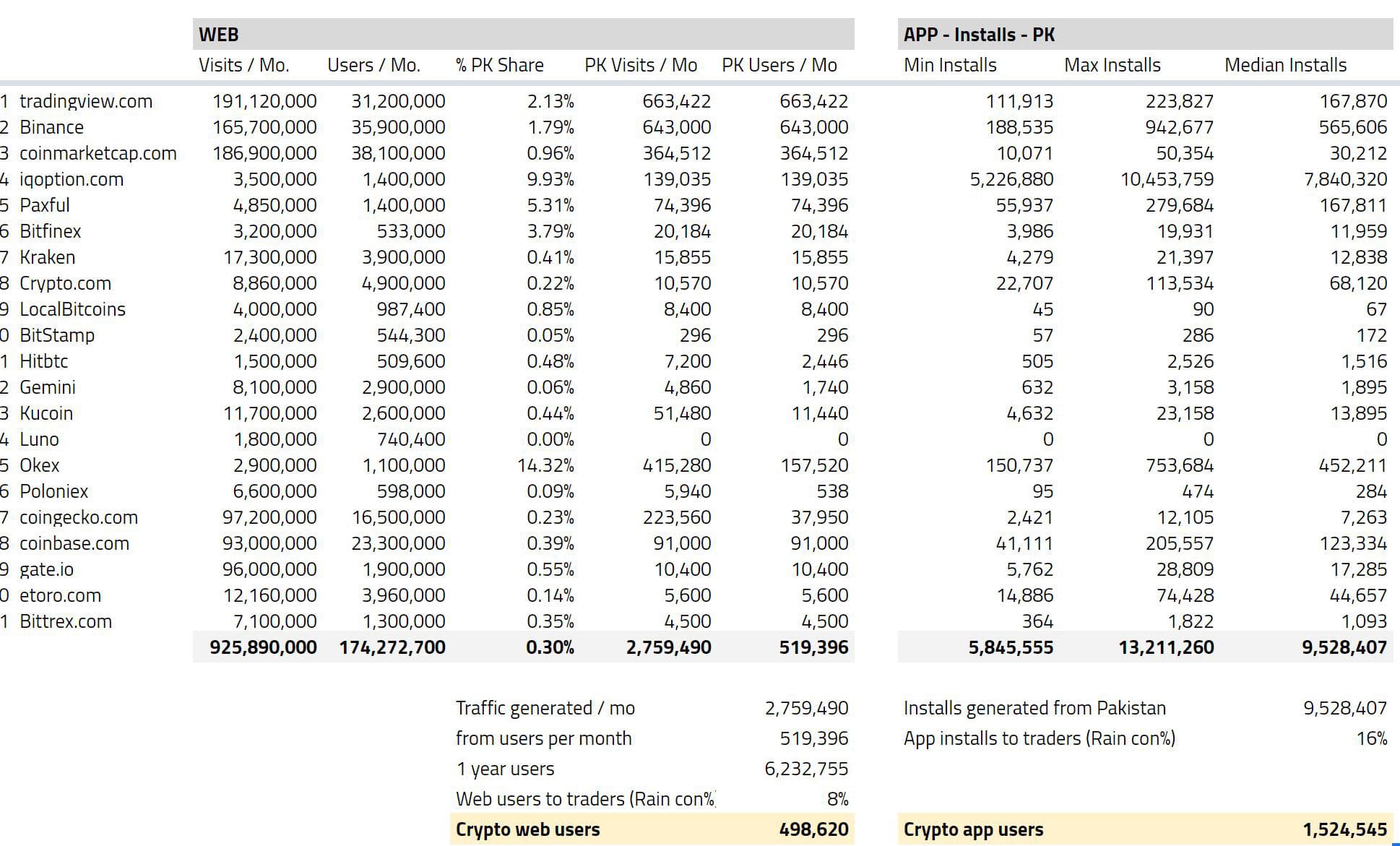

Based on traffic to various crypto exchanges and platforms (both on web and apps) from Pakistan, it is estimated that nearly 2 million Pakistanis trade cryptocurrencies in the country.

The Potential

While 1 to 2 million seems like a good number, it is pertinent to note that this is just beginning. For context, below are some facts about Pakistan’s internet population:

- Pakistan’s total population was 227.3 million in January 2022

- There were 193 million cellular mobile connections in Pakistan in May 2022

- There were 113 million 3G/4G users in Pakistan in May 2022

- There were 71.70 million social media users in Pakistan in January 2022.

- 144.4 million people in Pakistan did not use the internet at the start of 2022

- Median mobile internet connection speed via cellular networks: 16.35 Mbps

- There were 43.55 million Facebook users in Pakistan in early 2022

- Google’s advertising resources indicate that YouTube had 71.70 million users in Pakistan in early 2022

- Numbers published in Meta’s advertising tools indicate that Instagram had 13.75 million users in Pakistan in early 2022

- Figures published in ByteDance’s advertising resources indicate that TikTok had 18.26 million users aged 18 and above in Pakistan in early 2022

Now imagine where the userbase would stand in three to five years if trading is allowed, and people are given the liberty to buy crypto directly using their bank accounts, cards or mobile wallets.

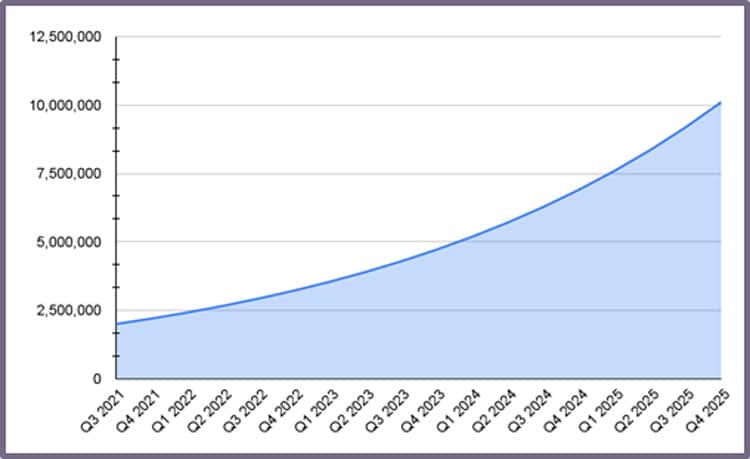

Rain Financial Inc. estimates that Pakistan’s crypto traders could reach the 10 million mark in 2025, meaning that the number of traders could grow by at least 5X in just three years from now.

Projected Crypto Users in Pakistan

With such a large userbase, it is clear that it cannot be ignored and must be regulated to support the investors, public and make billions from taxation. It is likely that the number of crypto traders will continue growing organically and at a gradual pace, but it would be a big mistake for the regulator to keep overlooking the segment.

Benefits of Regulating Crypto Currencies in Pakistan

While there are numerous benefits to regulating cryptocurrencies in Pakistan, some of the more impactful ones are mentioned below, starting with the much-needed tax money.

- Taxes: As rounded up yesterday, with the current number of users and a flat rate that India has applied (30% tax on crypto profits), Pakistan could make $200 million a year, or Rs. 40 billion per year, in taxes. This number is definitely going to grow if the market is regulated and everyone is allowed to trade in crypto.

- KYC Checks: With unregulated exchanges, the government currently has no track of individuals who are trading cryptocurrencies. Hence, there’s no information on who is earning how much and how they have been spending or trading crypto. This situation could result in illicit activities and may harm national security.

- Security: The government could gain knowledge of all the transactions happening on crypto exchanges. Everything is traceable, down to a single bit of information that the government may require, by eliminating the movement of illegal money, transfers, or cash changing hands and monitoring the crypto exchanges.

- Economic Benefits: If regulated and adopted by the masses, the blockchain technology and crypto market can offer an opportunity for newer business verticals, and expansion of the fintech sector.

- Faster and Cheaper Digital Settlements: If adopted by the masses, and used as a method of funds transfers (of stable coins for now only), blockchain will result in faster and cheaper (or completely free) and even more secure digital settlements.

- Save Millions in International Remittances fee: If international remittances are allowed through crypto, Pakistan could save on banking fees and charges. El Salvador, for instance, saved more than $400 million in remittance fees just last year.

- Foreign Investments: If the government allows exchanges and cryptocurrencies to be set up in the country, there could be tons of interest from foreign investors to tap the local population to invest and operate in the country. These investments could be in the power sector, blockchain-based projects, crypto mining industry and even some futuristic initiatives that could revolutionize the country.

- Financial Inclusion: Apps like EasyPaias and JazzCash will become a joke in presence of crypto transactions. Zero fees, 0-second delay, and unlimited free transactions with complete freedom will set new standards for the banking industry.

In other words, regulating cryptocurrencies could open the doors to a new financial era for Pakistan.

Case Study: Assume Pakistan has an app, developed by the government or the private sector in Pakistan – for the Pakistani audience, and it can act like a wallet for digital currency (or say a cryptocurrency) called PKR.

Now imagine paying bills with this coin, sending funds to each other or receiving funds from abroad. All possible in the blink of an eye.

Cons of Regulating Crypto Currencies in Pakistan

If I am honest, there’s no downside of regulating crypto in Pakistan, except one: People could lose their money during market crashes. But that is also true for the leveraged foreign exchange market and the stock exchange.

Like the ongoing crypto market crash, or a crash of a particular token (LUNA for instance), or the crash of 2018, people could lose billions of dollars and that’s a concern that may raise eyebrows of the regulator.

But then again, these crashes are valid for everyone (including those who are currently trading).

If adopted by millions of users, these crashes could wipe out billions of dollars of Pakistani money into hands outside Pakistan. If someone loses in crypto, there’s might be someone gaining from it; and those gainers could be outside Pakistan.

BluePrint of Regulating Crypto Currencies in Pakistan

In our conversation with crypto experts, it was confirmed that the regulation part is hard. Since it’s unchartered territory for the majority of nations, the ideal regulations are yet to be formed.

Having said that, there are some working models available in developed countries that can be adopted with some changes based on the local market to make sure that Pakistanis benefit the most from crypto and blockchain technologies.

What Pakistan can do, at best, is to allow crypto trading, start taxing the profits and meanwhile initiate the process of drafting and finalizing the regulations.

If we look at India, for instance, they are yet to finalize regulations on crypto, but they have allowed trading and 30% of all profits go into taxes. Additionally, a 1% tax is also imposed on every transaction.

This essentially means that while the government is preparing to regulate the market, which could take months, it can generate revenues that they badly need.

Things to be Noted

Unlike other countries, Pakistan is in dire need of dollars and it would not want the flight of currency to foreign lands. Considering this, Pakistan must bind exchanges for the following things:

- Exchanges must only allow the transfer of funds from PKR bank accounts to exchange, and then back from exchange to PKR bank account of the same title (This will eliminate any chances of illicit fund transfer).

- Exchanges must disallow the transfer of funds from exchange to private wallets (to eliminate the chances of flight of dollars to a foreign land, money laundering or any other illicit activity).

- Turn exchanges into tax collection agents, to charge the tax on every transaction and/or any profits made through any particular transaction.

- Make sure that exchanges give open access to any KYC, transaction details or any other specifics of a trade, account etc.

- Exchanges are also taxed as per usual local laws.

- Make it mandatory for exchanges to have a local presence in the country.

- Make sure that exchanges allow the trading of tokens after strict scrutiny.

- Make exchanges compensate for any privacy breaches, loss of funds or any damage happening due to flaws of the exchange itself.

Of course, all of this comes after proper verification and licensing of exchanges, which includes licensing fees, and requirements similar to fintech startups or even banks. The government will need to ensure that exchanges and trading platforms are backed with real money and offer insurance to the public. For a cash-strapped country like Pakistan, this could be the shortest path to increasing foreign exchange reserves and taxing businesses and traders who are currently invisible to the taxation system.

During the past couple of years, countries like El Salvador and big economies like the US, the UK and India have shown how the crypto market can be linked to the local economy and boost economic activity. With each passing day, Pakistan is losing potential investments, tax money and failing to stop the illicit transfer of finances. It would not be wrong to say that time is of the essence for Pakistan. A quick decision can pave the way for Pakistan to become home to the biggest crypto and blockchain businesses in the coming future while a slow or negative approach can halt progress and continue to damage the economy even further.