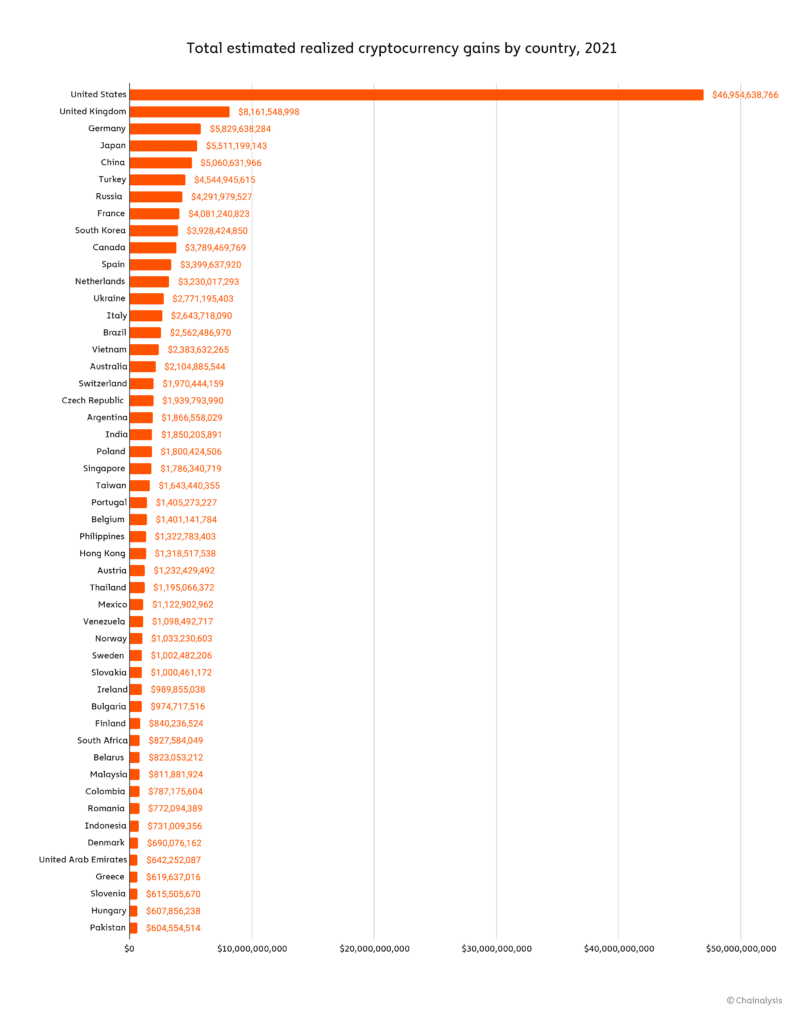

Pakistani investors earned more than $604 million in profits from cryptocurrencies during the calendar year 2021.

While the extent of the profits appears to be large, it is the smallest of any country covered by Chainalysis. Globally, the value of realized crypto profits was over $163 billion, with US investors leading the way with nearly $47 billion. The profits for Pakistanis were split almost evenly between Bitcoin and Ethereum. This is consistent with previous trends, in which the two flagship coins accounted for over 60 percent of the trade volume. The remainder was made up of altcoins and stablecoins, which appear nowhere in terms of returns.

According to analytics firm Chainalysis, Pakistanis bought heavily into the crypto game last year, with scores of individuals pocketing over $604.5 million. At the average digital exchange rate, this amounts to more than Rs. 98 billion in total profits earned during the period in review.

More data from Chainalysis suggests that Pakistan was placed third in the Global Crypto Adoption Index. Between July 2020 and June 2021, Pakistanis reportedly had more than $20 billion in virtual/crypto assets. This number represented the cryptocurrency value received by Pakistan during FY21. This figure generated quite a commotion among economists and analysts alike, as many people mistook it for assets possessed.

Regulators at the time were alarmed that increased crypto trading activity may result in dollar outflows and deplete forex reserves. Consequently, a group comprised of the State Bank of Pakistan (SBP) and other regulators proposed that cryptocurrencies be prohibited in Pakistan. However, it appears that this has not deterred Pakistanis from adopting Web 3.0, the third generation of the worldwide web constructed with decentralized technology such as blockchain, peer-to-peer networks, and so on.

Globally, crypto investors realized total gains of $162.7 billion in 2021, compared to just $32.5 billion in 2020. The United States leads by a wide margin at an estimated $47.0 billion in realized cryptocurrency gains, followed by the UK, Germany, Japan, and China.