According to research by Counterpoint, premium smartphone sales reported an all-time high in 2021, with Apple topping the charts around the globe. The research shares that premium smartphone market sales witnessed a YoY growth of 24% globally, which is the highest ever reported.

Commenting on the premium market growth in 2021, Research Director Tarun Pathak said:

The global premium smartphone market sales grew 24% YoY in 2021 to reach their highest ever level. The growth in the premium segment outpaced the 7% YoY growth in the overall global smartphone sales in 2021. The premium segment alone contributed to 27% of the global smartphone sales, its highest ever share.

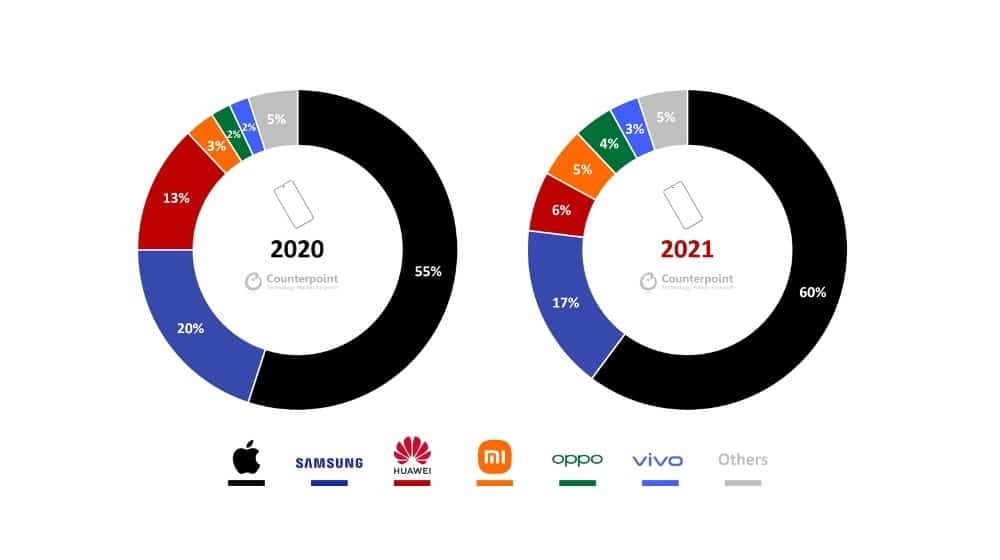

In terms of OEMs, Apple remained dominant in the market reaching the 60% sales mark for the first time since 2017, followed by Samsung, Huawei, Xiaomi, Oppo, Vivo, and several others.

Apple’s impressive performance was driven by strong 5G upgrades for the iPhone 12 and iPhone 13 models. Additionally, the delayed launch of Apple devices in 2020 fostered the demand in 2021. Other factors that contributed to the sales spike are the growing demand for 5G devices, OEM strategy, and supply chain dynamics.

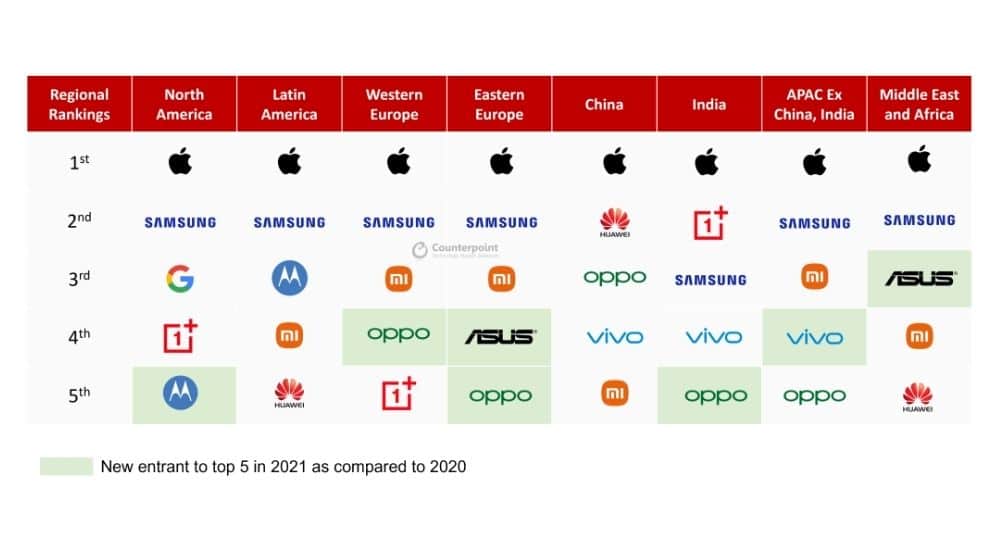

The iPhone manufacturer is also said to be best placed to take advantage of Huawei’s implicit demise. Apple’s growth in the Chinese market is a clear demonstration of this, where the brand reached its highest ever market share in Q4 2021.

Furthermore, research has proven that 5G has become a standard option in the premium segment. As 5G begins to penetrate developing markets in 2022, LTE’s share of the market is expected to decline.

Meanwhile, Samsung’s sales increased by 6% YoY, but the company lost its market share owing to component shortages. The Galaxy S21 outperformed the pandemic-inflicted Galaxy S20. The Galaxy Z Fold and Z Flip phones, launched in the second half of 2021, were also well-received, especially in South Korea, North America, and Western Europe regions.

However, due to the lack of a Galaxy Note or a Fan Edition (FE) model in 2021, the shares were severely impacted.

On the other hand, Oppo and Vivo’s premium smartphone sales more than doubled in 2021, reporting an increase of 116% and 103%, respectively. This enabled them to secure a spot among the top five premium brands in various markets.

Oppo Reno’s rebranding in early 2021 also helped Oppo in acquiring China’s affordable-premium sector. Oppo has also been gradually increasing its market share in Europe, attempting to fill the void left by Huawei.

Xiaomi’s advantage was driven by the Mi 11 series, which got Xiaomi among the top-five premium brands in almost all the regions where it operates.

The research revealed that ASUS has also profited from its focus on the niche gaming sector. It’s also worth mentioning here, that as a result of LG’s retirement from the smartphone industry, Motorola, Google, and OnePlus have increased their market share in North America.